The Rürup pension is intended as a pension system for self-employed persons who are not allowed to contribute to the statutory pension. Nevertheless, employees can also take out a Rurup pension.

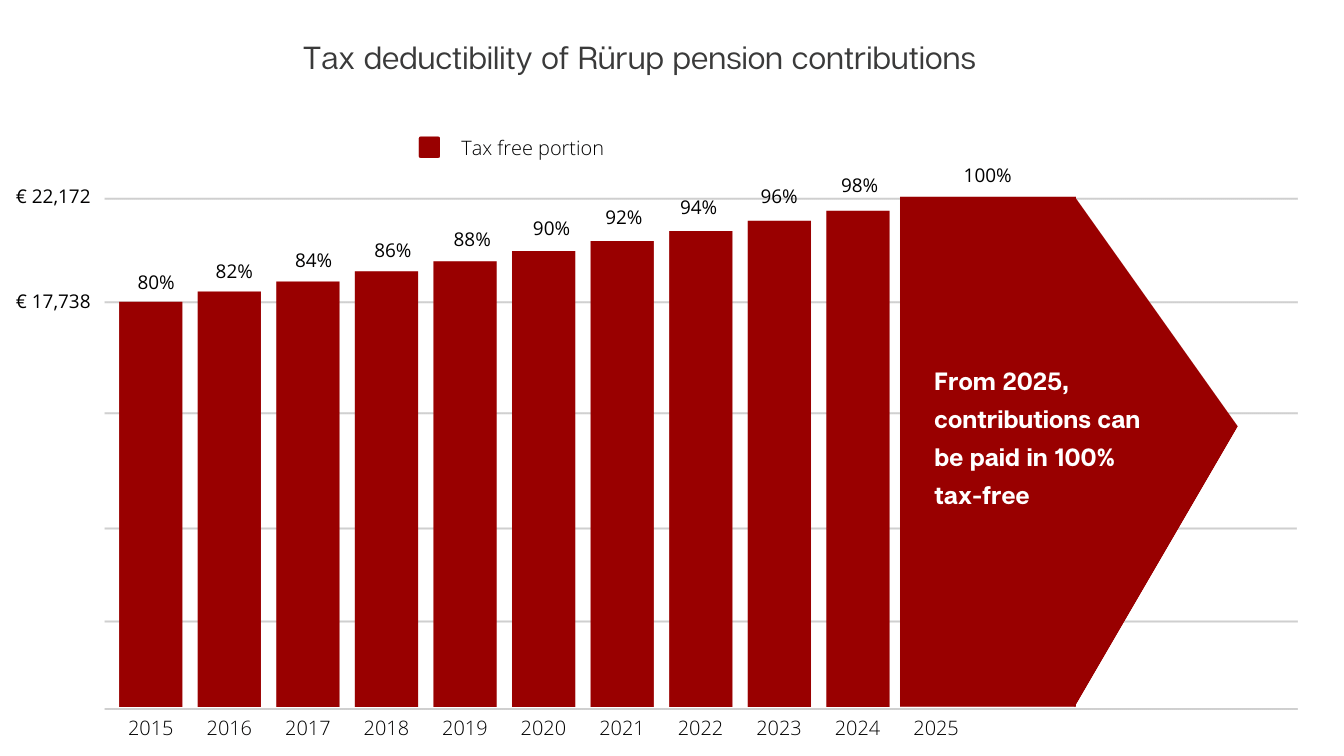

The state promotes the basic pension (Rurup) through tax benefits. From 2025, savings contributions will be tax-free up to a maximum rate. In 2022, 94% of the amounts paid in are tax-free up to the maximum rate.

The payment of the saved amount is possible only as a monthly pension. There is no one-time payment.

The amounts paid in are protected. Even in the worst case of insolvency, debtors cannot liquidate the capital from the Rurup pension.

Good to know: The basic pension (Rurup) is very interesting not only for the self-employed, but also for employees with a good income.

Employees have statutory pension insurance and usually make additional provision with a Riester contract and a company pension plan. For the self-employed and freelancers, these two variants of private pension provision do not exist. The Rürup pension, also known as a basic pension, is the alternative pension insurance for the self-employed.

The Rurup pension is a private pension plan that is subsidized by the state. Self-employed persons can choose between three variants:

100% English-speaking advisors - "Life is too short to learn German".

Offers from more than 150 insurance companies - with us you really have the choice

Many years of experience and specialisation - we know the needs of expats

ask the experts

Get to know us